The British government has continued its spending and borrowing spree into the second year of the pandemic, with the state borrowing £136 billion over the fiscal year to November.

While the government has professed a desire to reign in the spending spree that has occurred since the start of the Chinese coronavirus crisis, government expenditures in November were the highest since record began 30 years ago, with the exception of the first year of the pandemic when the government introduced an 80 per cent wage furlough for millions of workers.

The £17.4 billion spent in November far outpaced the £16bn predicted by a poll of economists for Reuters, with rising inflation driving higher debt interest costs, alongside higher than expected spending on the vaccine and test and trace programmes, The Guardian reported.

In total, the debt accrued during the fiscal year leading up to November was also the second highest on record after last year, with some £136 billion borrowed by the government, the Office for National Statistics (ONS) said.

Public sector net debt (PSND) — the amount of debt accumulated over the years — also rose to £2.3 trillion by the end of November. This means that the PSND level has risen to 96.1 per cent of the nation’s GDP, the highest level recorded since March of 1963, when it stood at 98.3 per cent.

The government spending all occurred prior to the latest round of restrictions imposed after the emergence of the Omicron variant of the Wuhan virus, therefore state spending is likely to continue to rise before the end of the year.

Commenting on the troubling data, economist at Capital Economics, Bethany Beckett said: “These data predate the recent surge in coronavirus infections caused by the Omicron variant, with a near-term tightening of virus restrictions once again a possibility.

“Although the economy has got better at coping with restrictions with each new wave, we still suspect it would prompt a deterioration in the public finances via lower tax revenues and the potential reintroduction of government support schemes.”

With the prospect of more lockdown restrictions being put in place in the coming days, a survey from the Night Time Industries Association (NTIA) has warned that as much as one third of nightclubs, pubs, bars, and other hospitality businesses fear that they may have to close down for good in the next month.

‘If further restrictions are to be implemented, the Chancellor must step in and recognise the huge damage that waves of cancellations, driven by mixed Government messaging, resource intensive Covid protocols and costly restrictions actually have,” Michael Kill, the chief executive of the NTIA said per the Daily Mail.

“The Government have had twenty months to learn how our sector operates; it is beggars belief we stand here again, as if back in March 2020, imploring the Government to listen to us, to understand how businesses work and to realise that inaction is a death sentence for our industry. It really is a Cataclysmic Christmas,” he lamented.

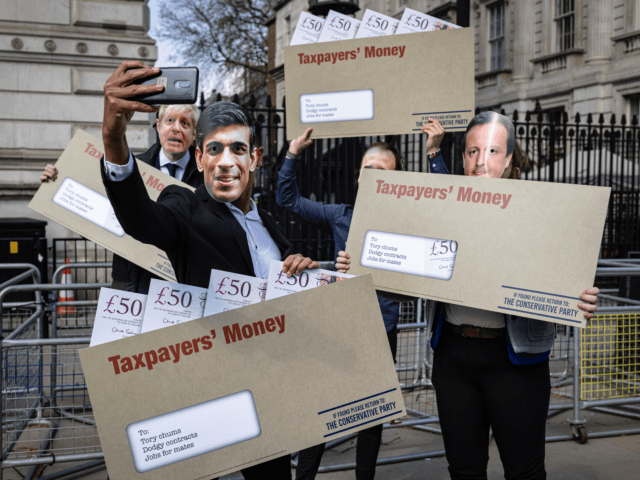

In response to the massive borrowing spree, the supposedly Conservative government of Prime Minister Boris Johnson has announced the highest level of taxation in seventy years to cover the exploding costs.

The big spending and high tax agenda from the government has drawn criticism from the right within the Tory Party, with even Brexit negotiator Lord David Frost resigning from the government over Johnson’s leftist agenda and coronavirus lockdown policies.

Follow Kurt Zindulka on Twitter here @KurtZindulka

COMMENTS

Please let us know if you're having issues with commenting.